Mainstreet Equity: Needs A Catalyst - Mainstreet Equity Corp. (OTCMKTS:MEQYF)

Mainstreet Equity (OTC:OTC:MEQYF) is an under-the-radar residential apartment owner/operator in Western Canada. Despite a market cap of $325m (all figures Canadian), it often sees volume of less than 1000 shares a day on the TSX where it trades under the MEQ ticker.

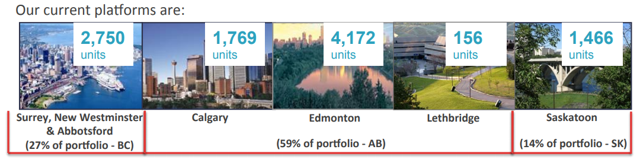

The recent investor presentation (July 2017) gives a brief snapshot of the properties Mainstreet controls.

It's important to note that Mainstreet is well away from the frothier markets in Canadian real estate, both geographically and in terms of price point. The average apartment it owns is valued at just marginally more than $100k with an average monthly rent of just $864. These are solidly middle class, leaning lower middle class, properties.

The company is focused on rolling up what they view as smaller, underperforming buildings, often ones that have fallen into significant disrepair, are being managed by inexperienced and/or unprofessional owners, and giving them a makeover, with some recent examples from the same presentation below:

Mainstreet has been very successful at doing this, growing its portfolio from a few hundred units to more than 10,000 apartments while simultaneously carrying out significant buybacks, which I'll return to later.

Mainstreet has been very successful at doing this, growing its portfolio from a few hundred units to more than 10,000 apartments while simultaneously carrying out significant buybacks, which I'll return to later.

However, the stock has been stuck in a rut for the last couple years following the decline of oil prices after an incredible run since the financial crisis.

MEQ data by YCharts

MEQ data by YCharts

Western Canada Select, the grade of oil that serves as a benchmark for most oil sands producers, went from averaging $US 89.53 in Q3 2014 to $22.51 in Q1 2016, and took the air out of the western economy with it. (Data Source)

Another reason that the stock price has been stuck is that book value per share has been marked down consistently over the last couple years as the western Canadian economy forced Mainstreet to reevaluate its holdings. In the company's quarterly results ending June 30th, Mainstreet booked a $17.3m fair value decrease in its real estate portfolio, even with oil recovering somewhat and stabilizing in 2017. Conversely, for those with a contrarian bent, this just means there's upside in the stock even if the Alberta and Saskatchewan markets are simply dead flat going forward.

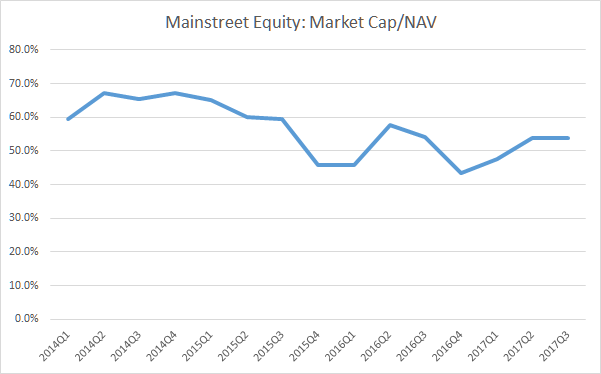

Here's what market value to book value looks like going back over the last 15 quarters from my own calculations out of the quarterly reports and historical share prices. I'm using the basic share count - using the fully diluted count would shift the line up slightly, but not change the pattern or slope.

So, while Mainstreet does trade at a significant discount to book, it seems unreasonable to expect that this gap is going to close at all in the near future. This is at least somewhat notable because I view Mainstreet as a company that's friendly to minority shareholders. Many property companies that consistently trade below NAV, including for example Morguard REIT which I wrote about recently, have clauses on the books where they make significant payments to related entities for asset management services. Another example is Senvest Capital, where a discount to NAV is being driven at least in part by hedge fund style compensation due to managers.

So, while Mainstreet does trade at a significant discount to book, it seems unreasonable to expect that this gap is going to close at all in the near future. This is at least somewhat notable because I view Mainstreet as a company that's friendly to minority shareholders. Many property companies that consistently trade below NAV, including for example Morguard REIT which I wrote about recently, have clauses on the books where they make significant payments to related entities for asset management services. Another example is Senvest Capital, where a discount to NAV is being driven at least in part by hedge fund style compensation due to managers.

Mainstreet is a fully independent entity which has no such drains or costs on its books. Management is completely aligned with the interests of minority shareholders, with the CEO Bob Dhillon owning roughly 37-40% of the company depending on source. In fact, the company makes just these points on its website.

Reading the quarterly reports, management consistently reports dissatisfaction with the large discount to NAV being applied, to the point where they put money behind their words and repurchased approximately 15% of the float in 2016, with shares outstanding decreasing from 10.1m in March 2016 to 8.9m in December 2016 - but the overall discount to book value barely changed.

A buyback of that magnitude suggests that Mainstreet does a pretty good job of generating cash. To try and make that clear, let me compare Mainstreet to the standard bearer for the Canadian real estate industry, Canadian Apartment Properties (OTC:OTC:CDPYF).

Net operating margin: both companies at 63%, Mainstreet historically closer to 65%, CAPREIT historically closer to 60%.

FFO yield: Mainstreet generates FFO of about 8.4% of market value annually, CAPREIT roughly 5.5% (yields less than 4% and pays out 70%).

Leverage: Mainstreet has debt/assets of 0.61, compared to 0.44 for CAPREIT.

Vacancy rate: Significant different, with 10.6% for Mainstreet compared to 1.4% for CAPREIT.

Capitalization rate: 5.34% for Mainstreet, relative to 4.46% for CAPREIT.

Overall, Mainstreet looks very good on valuation measures compared to CAPREIT. The company maintains equal margins and generates considerably more income, in part from greater leverage, but despite a massive difference in occupancy rates driven largely by Mainstreet's inability to find tenants (and not just a ton of retrofit/renovations, as the reports would try to suggest).

There are two ways to look at this. One, Mainstreet has a margin for extra revenue. Two, Mainstreet is not as high-quality an operator. I'm willing to grant CAPREIT an edge on quality, but Mainstreet has demonstrated a long track record of building value around apartment consolidation, and I can't find or identify any reason within their public materials or in any news releases why that vacancy rate shouldn't come down considerably going forward.

The worst source of vacancies is Saskatoon, where the company reports a 16.9% vacancy rate - and despite this maintains a 62% NOI margin. The Canadian Mortgage Housing Corporation characterizes the metropolitan area as strongly overbuilt, with moderate overvaluation, with no sign of overheating or price acceleration. I have no special ability to time regional housing markets in Saskatchewan, but I'd rather buy in at the bottom of the market than the top.

Where does that leave the company? One immediate possible catalyst for the share price would be for Mainstreet to start paying a considerable dividend. A 5% dividend would be very manageable for the company, and in that world I imagine they'll generate a lot more investor attention as real estate investors often key in on yield. While this is possible, I can't imagine it actually happening - the management is too savvy and would almost certainly opt for returning more capital to shareholders through buybacks.

In fact, one of the reasons I like the company in its present incarnation is that it doesn't pay a dividend. I have never cared strongly about where my total return is coming from - but if a company is undervalued and underappreciated because it tries to compound the share price instead of focusing on income, that's a plus for me.

Overall, I remain worried that I'm buying into a value trap. I can't see exactly what it might take for the market to rerate the equity, but I'm confident my downside here is very limited. I want some Canadian residential real estate in my portfolio, and buying Mainstreet here comes with a lot of downside protection, a marked avoidance of Toronto and Vancouver, and a favorable valuation compared to the standards of the sector.

Disclosure: I am/we are long MEQYF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Comments

Post a Comment